WSQ Effective Uses and Applications of Incoterms in International Trade

This training programme aims to equip learners with skills and knowledge in practical applications of Incoterms in international trade, as well as the common variants in use, including Carrier/Liner Terms and Freight Forwarder’s Terms. Learn all about the changes to the rules, what has been retained, and what the obligations are.

At the end of the training programme, the learner will be able to:

- Apply the terms in a practical manner.

- Use the terms to your advantage.

- Understand the rights and obligations of the buyer and seller.

- How Incoterms can be a powerful tool in your business dealing.

1. Introduction

2. Why you need Incoterms

3. What are Incoterms

4. Why and when are Incoterms used

5. Key points of Incoterms

6. Incoterms 2020

7. Incoterms: Terms Definition

8. Changes to Incoterms

9. The Retained Incoterms rules

10. Incoterms: The Obligations

11. Case Studies and Analysis

12. Transfer of Risks

13. Incoterms Variants – Common variants in use

14. Carrier / Liner Terms

15. Freight Forwarder’s Terms

16. Specific Industry Incoterms / Shipping / Delivery Terms

17. Additional selected cases for analysis and discussion

Who Should Attend?

Suitable for Importers, Exporters, Sellers, Buyers, Traders, Bankers, Insurers, Claims Handlers, personnel involved in International Trade, Contracts, Documentation & Shipping, Finance & Management, Fraud Prevention & Management, and Trade Dispute Resolution.

This course adheres to the SSG Skills Framework <International Trade Legislation Compliance-2 WST-FFO-2011-1.1-1>. Trainees who attended at least 75% of the scheduled class, demonstrated competency in the WSQ assessment, and participated during the scheduled class will receive these two e-certificates with the aforementioned skills under the SSG Skills Framework.

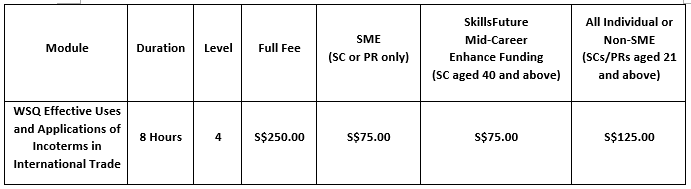

*Course fees before GST

Note that purchases of goods and services from GST-registered businesses will be subject to GST at 9% GST. The GST amount calculated will be based on full course fees.

Completed PSLE and are able to speak, read and write in basic English

1. All notice of transfer/withdrawal / deferment must be given in writing and submitted at least 2 weeks prior to course commencement.

2. An administrative fee of $60 (GST inclusive) will be imposed if notice is received less than 2 weeks.

3. If notice of withdrawal is received:

– At least 1 week before commencement of the course, a 20% of the full course fee will be charged. For government-funded course, a 20% of full course fee before funding will be charged.

– Less than 1 week before commencement of the course, a 30% of the full course fee will be charged. For government-funded course, a 30% of full course fee before funding will be charged.

– No show on the scheduled date, a full course fee will be levied. For government-funded course, a full course fee before funding will be charged.

4. For all government-funded programmes (WSQ & Non-WSQ), funding is only applicable to:

– Singapore Citizens or Singapore Permanent Residents.

– Participants who have achieved at least 75% attendance and passed all required assessments.

– Full course fee will be charged to participants who fail to meet the above-mentioned criteria.

5. Certificates or Statement of Attainment or Certificate of Attendance will only be issued to participants who have achieved 75% attendance and undergo assessment (if applicable).

6.When a course is cancelled, fails to commence or fails to complete under unforeseen circumstances, participant is allowed to defer the intake at no cost or withdraw from the course; under such situation, a full refund of the advance payment will be given.

7. Notice of change in participant’s name must be given in writing, no less than 5 days prior to course commencement.

8. SMF reserves the right to change the venue, cancel or postpone the event without prior notice and full refund will be given under such circumstances. Such modifications shall become effective immediately upon the posting thereof. Please approach your account manager for more queries.

9. SMF Centre for Corporate Learning Pte Ltd has a Data Protection Policy which provides more information about how we collect, use and disclose your personal data. Please click the link below to know more.

https://www.smfccl.sg/privacy/

1. The candidate has the right to disagree with the assessment decision made by the assessor.

2. When giving feedback to the candidate, the assessor must check with the candidate if he agrees with the assessment outcome.

3. If the candidate agrees with the assessment outcome, the assessor & the candidate must sign the Assessment Summary Record.

4. If the candidate disagrees with the assessment outcome, he/she should not sign in the Assessment Summary Record.

5. If the candidate intends to appeal the decision, he/she should first discuss the matter with the assessor/assessment manager.

6. If the candidate is still not satisfied with the decision, the candidate must notify the assessor of the decision to appeal. The assessor will reflect the candidate’s intention in the Feedback Section of the Assessment Summary Record.

7. The assessor will notify the assessor manager about the candidate’s intention to lodge an appeal.

8. The candidate must lodge the appeal within 7 days, giving reasons for appeal together with the appeal fee of $109.00 (inclusive of 9% GST).

9. The assessor can help the candidate with writing and lodging the appeal.

10. The assessment manager will collect information from the candidate & assessor and give a final decision.

11. A record of the appeal and any subsequent actions and findings will be made.

12. An Assessment Appeal Panel will be formed to review and give a decision.

13. The outcome of the appeal will be made known to the candidate within 2 weeks from the date the appeal was lodged.

14. The decision of the Assessment Appeal Panel is final and no further appeal will be entertained.

15. Please click the link below to fill up the Candidates Appeal Form.